In court this may require expert evidence. It is not a matter of taste. It is a matter of aesthetic judgment. At common law English Judges have accorded ‘art’ with a wide and liberal meaning. In Haunch of Venison Partners Ltd v. Her Majesty’s Commissioners of Revenue and Customs [2008] the Tribunal judges noted that while the American case of Brancusi v. United States (cited by the Appellant’s counsel) was not an authority binding on the Tax Tribunal, that the court in that case acknowledged the relevance of expert evidence about whether the creator of the artwork in dispute was a professional sculptor, ‘as is shown by his reputation and works in the manner in which he is considered by those competent to judge upon that subject.‘ The essential questions debated before the court in Brancusi concerned the criteria for determining what was a work of art? Who was an artist? And who was to judge these questions? The judge held, ‘[There] has been developing a so-called new school of art whose exponents attempt to portray abstract ideas rather than to imitate natural objects. Whether or not we are in sympathy with these new ideas and the schools which represent them, we think the fact of their existence and their influence upon the art world as recognized by the courts must be considered. The object now under consideration is shown to be for purely ornamental purposes, its use being the same as that of any piece of sculpture of the old Masters. It is beautiful and symmetrical in outline, and while some difficulty might be encountered in associating it with a bird, it is nevertheless pleasing to look at and highly ornamental. And as we hold under the evidence that it is the original production of a professional sculptor and is in fact a piece of sculpture and a work of art according to the authorities … We sustain the protest.’ During cross-examination, the judge asked the expert, ‘do you mean to tell us that Exhibit 1, if formed up by a mechanic – that is, a first-class mechanic with a file and polishing tools – could not polish that article up?’ In reply, the expert made a critical distinction, ‘he can polish it up, but he cannot conceive of the object. That is the whole point. He cannot conceive those particular lines which give it its individual beauty. That is the difference between a mechanic and an artist: he (the mechanic) cannot conceive as an artist.’ The judge then asked, ‘if he can conceive, then he would cease to be a mechanic and become an artist?’. The expert replied, ‘would become an artist; that is right.’ Based upon this reasoning, arguably a Hologram is capable of being art – see: https://lnkd.in/eJMnwfcw. If a Holgram is art, then logically it follows that in principle artists’ may have moral rights which can give rise to commercial claims. This is also linked to the existence of intellectual property rights in AI. See also: https://lnkd.in/ehG3jrsn.

Monthly Archives: July 2023

‘Bollywood at the Proms – Prom 18: Lata Mangeshkar: Bollywood Legend’

If you missed it you can play it on the BBC i-player. This was a complete triumph! and for me it is was not only joyous – it was the ‘stand-out’ Prom so far of 2023. The songs of Lata Mangeshkar are universal in their beauty and appeal, and watching the Prom last night I could hear cadences of African Arabic and Persian influences influences in the music and saw this in the dance. These ideas, styles, and tastes which are unique to India, I suspect have been influenced by merchants who have been travelling accross the Indian Ocean and the Arabian Sea to India to trade since ancient times. So, you can drift back in time when you watch such a performance which is rich with customs and protocol that has been enriched by other cultures over centuries. That is why this music and dance, which laden with symbolism and hidden meaning is for everybody. Music truly brings the world together. Bravo to the artists and to the https://cbso.co.uk/events/the-cbso-at-the-bbc-proms-28-july for letting us into the rich world of India’s musical heritage and living culture.

I think Palak Muchhal made her Proms debut 23.07.2015, see: https://m.youtube.com/watch?v=HHVPwNOKoFA

My next article for Taxation (Tolley) – ‘Tax-Efficient Settlement of Art Disputes.’

Over the next 28 days I am undertaking the ‘Taxation of Art’ Module of the ‘Diploma in Art Law’ Course at IAL’s (ial.uk.com). This is the 10th & final course module. After that I have to write 3 essays. 1 of them is entitled, ‘Tax-Efficient Settlement of Art Disputes.’ I am writing this in August. I have also been commissioned by Taxation (Tolley)(https://lnkd.in/eeP3-vCY), to write an article with the same title, for publication throughout the UK & online (to subscribers) later in the year. The subject is global. To provide a flavour to family offices, tax & legal advisors, mediation advocates & mediators, the introduction to the essay and article currently reads:

‘The taxation of art assets, which may be chattels (including classic cars), land and buildings, or intangibles e.g. non-fungible tokens (‘NFT’s) [‘Art’], depends upon:

· how ownership is structured; and

· dealing/commercial exploitation – i.e. chargeable transactions.

Settlement of an art dispute may result in a transaction i.e. by transfer, sale or gift, which can be structured so as to increase the settlement pie, by maximising available tax exemptions and reliefs. In this article the author discusses:

- Chargeable events which arise when an art transaction takes place by transfer, sale or gift.

- Tax-planning concepts which apply to art and heritage property.

- Tax exemptions and reliefs available in the UK for art and heritage property.’

‘Mediating Estate & Succession Planning for an International Business Family’

If an international business family does not know how to start an inter-family discussion about how to put their house in order before a monumental event occurs – such as loss of capacity or death of the head of the family – a pre-emptive process of mediation can be used to create a safe space in which each key family member [‘P’] is empowered to:

● voice their individual needs, concerns, hopes, expectations and priorities to a non-partisan and beneficially disinterested person, who is bound by confidentiality and has the soft skills to talk to each of them; and

● speak through the mediator, to a multi-disciplinary team of professional advisers around the world, appointed by the family office.

They can then discuss, develop, and agree bespoke and innovative solutions to the problem, ie a holistic strategic plan and roadmap for practical implementation. For example, where P’s in mediation adopt the paradigm of a ‘store of value’ to perceive and reconfigure the attributes and worth to each of them of a luxury asset and the wishes, needs and priorities of each P are asymmetrical, it may be possible to design a bespoke solution to the problem of reconciling their competing and potentially conflicting claims and priorities, by restructuring the legal and beneficial ownership, management and control, use, enjoyment and commercial exploitation of the asset, to their mutual advantage.

Where mediation is used as a process for innovative and bespoke lifetime estate and business succession planning, ideally a qualified tax adviser should be appointed to prepare an estate planning report and a business succession planning report, which should be prepared after an inventory/schedule of the composition & value of the estate & family business has been prepared & before the mediator proceeds to interview each P:

● to confirm their acceptance of the facts set out in the inventory/schedule, so that from the outset all P’s in the process are singing off the same song sheet; and

● about what they each, want, need, prioritise and why.

In the case of an international family, their lawyers and tax advisers – appointed by the family office – can then engage with the P’s through a process of facilitated/mediated discussion to agree a holistic strategy and roadmap for practical implementation that is approved by each P. This may result in the drafting of a family constitution & in the redrafting of the articles & memorandum of association of a family-owned company, a shareholders’ agreement & of an international trust deed, which are no longer fit for purpose. See my article – ‘Mediation and Estate/Business Succession Planning’. Taxation (Tolley) on the ‘Publications’ page at www.carlislam.co.uk. Over the next 28 days I will be undertaking the ‘Taxation of Art’ Module of the ‘Diploma in Art Law’ Course at IAL’s.

‘Mediating Art Disputes’

At trial in a misattribution claim, unless the claimant can establish the link between breach and damage, the technical litigation risk is that the claim will fail. In any negligence claim, there is an essential intrinsic link between: (i) the breach of duty alleged; and (ii) the damage caused by it. The converse of this is that the measure of damage has to relate to the duty of care and its breach. Damage is the essence of the cause of action in negligence, and the critical question in a particular case is whether the scope of the duty of care in the circumstances of the case is such as to embrace damage of the kind which the claimant alleges to have suffered. It is therefore always necessary to determine the scope of the duty by reference to the kind of damage from which ‘A’ must take care to save ‘B’ harmless. As Lord Oliver emphasized in Murphy v. Brentwood District Council [1991] 1 AC 398, 486:

‘The essential question which has to be asked in every case given that damage which is the essential ingredient of the action has occurred, is whether the relationship between the [claimant] and the defendant is such … that it imposes upon the latter a duty to take care to avoid or prevent that loss which has in fact been sustained.’ This question necessarily subsumes the question whether the acts or omissions of the defendant caused the damage relied on. The loss must have a sufficient causal connection with the subject matter of the duty. The claimant has to prove both that he suffered loss and that the loss falls within the scope of the duty.’ A compelling reason for mediating misattirbution claims is that, the ‘English courts have established a diligence test that considers whether at least one other competent expert in the auctioneer’s position would have hypothetically reached the same conclusion as the mistaken auctioneer. Should this be the case, then the false attribution has been made with respect of the auctioneer’s duty of diligence. Generally, the harmed consignor may only succeed in his claim if all experts agree that the auctioneer was not reasonable in reaching the wrong attribution, or if all the expert evidence brings the court to decide – based on a preponderance standard – that the auctioneer’s attribution was not that of a reasonable expert. As a result the diligence test departs from the assumption of an attribution consensus among experts. The diligence test formulated by the English courts has two shortcomings in addition to the drawbacks of the reasonable auctioneer standard. First, the diligence test fails when no expert consensus exists at the time of the wrong attribution, secondly, the English rule is weakened by the circularity and contingency of scholarship, exposing attributions to divergences among scholars and to continuous changes.’ (The Sale of Misattributed Artworks and Antiques at Auction’ by Anne Laure Bandle, p.287).

‘Trust Industry Practice’

As Mr. Justice Newey (as he then was) said in Avrora Fine Arts Investment Limited v. Christie, Manson Woods Limited [2012] EWHC 2198 (Ch) [38], ‘A judge is not bound by expert opinion. A judge may presume to find that an expert’s final opinion is based on illogical or even irrational reasoning and reject it. But the judge should not himself assume an expertise he does not possess.’ Thus, a judge should not refuse permission for the admission of expert evidence about industry best practice in relation to the making of trustee decisions about investments in a trust and estate dispute on the grounds that he/she can form an opinion based upon what he/she reads in the tabloid press about the state of the market. So, if a judge says that there is no need for expert evidence in order to assist the court in deciding whether an executor has behaved in breach of fiduciary duty in selling investments by failing to obtain any professional investment advice before selling investments in a bear market, that would appear to provide a ground for appeal. In my experience, some senior practitioners who hold themselves out as being ‘experienced’ contentious probate and trust specialists do not know that in relation to the exercise of their powers of investment, executors are trustees for the purposes of the Trustee Act 2000, i.e. because s.28 of the Trustee Act 2000 clearly and unequivocally states: ‘(1) Subject to the following provisions of this section, this Act applies in relation to a personal representative. administering an estate according to the law as it applies to a trustee carrying out a trust for beneficiaries. (2) For this purpose, this Act is to be read with the appropriate modifications and in particular—

a. references to the trust instrument are to be read as references to the will, b. references to a beneficiary or to beneficiaries, apart from the reference to a beneficiary in section 8(1)(b), are to be read as references to a person or the persons interested in the due administration of the estate, and c. the reference to a beneficiary in section 8(1)(b) is to be read as a reference to a person who under the will of the deceased or under the law relating to intestacy is beneficially interested in the estate).’ Therefore, if a practitioner who does not know the law makes a legally erroneous submission about the relevance of expert evidence in relation to allegations of breach of fiduciary duty by an executor/trustee, and the judge accepts the argument, then that would also appear to ground an appeal. See my article ‘Electing between equitable remedies’, published by Trusts & Trustees (Oxford University Press) on the ‘Publications’ page at www.carlislam.co.uk. The litigation risk of a judge not allowing expert evidence to be adduced at trial is a reason why in contentious probate cases where expert evidence is required, it is better to mediate.

‘How HMRC can attack an Offshore Trust’

1. ‘Sham’ – see para 7.8 of my book the ‘Contentious Trusts Handbook’.

2. ‘Illusory trust’ – see para 7.9 of my book & use the search box at the top of the blog to search for – ‘Challenging the validity of an offshore trust as being an illusory trust.’

3. ‘Jurisdiction’ – use the search box at the top of the blog to search for ‘Challenging the jurisdiction of an Offshore Trust.’

4. ‘Failure to constitute’ – use the search box at the top of the blog to search for – ‘The offshore trust that never was!’

5. ‘Validity’ – use the search box at the top of the blog to search for – ‘Can the validity of an offshore trust be challenged in the English court by HMRC seeking a determination of the applicable law?’

6. ‘There is [also] a potential elephant-sized trap in conducting the mediation of an offshore trust dispute face to face in an onshore jurisdiction [which in my experience very few trust practitioners appear to be aware of /switched on to], as a revenue authority may challenge the tax residence of the trust; therefore, it may be necessary to obtain tax advice before agreeing to the venue. … [G]reat care should be taken when setting up the mediation of an international trust dispute.’ – See my article ‘Mediating Probate and Trust Disputes – Process Challenges and Tools – Part 1.’ Published by Oxford University Press in ‘Trusts & Trustees’ worldwide in the journal in February 2023.

I can also think of several other technical ways in which a revenue authority could attack an offshore trust – but nobody is asking!

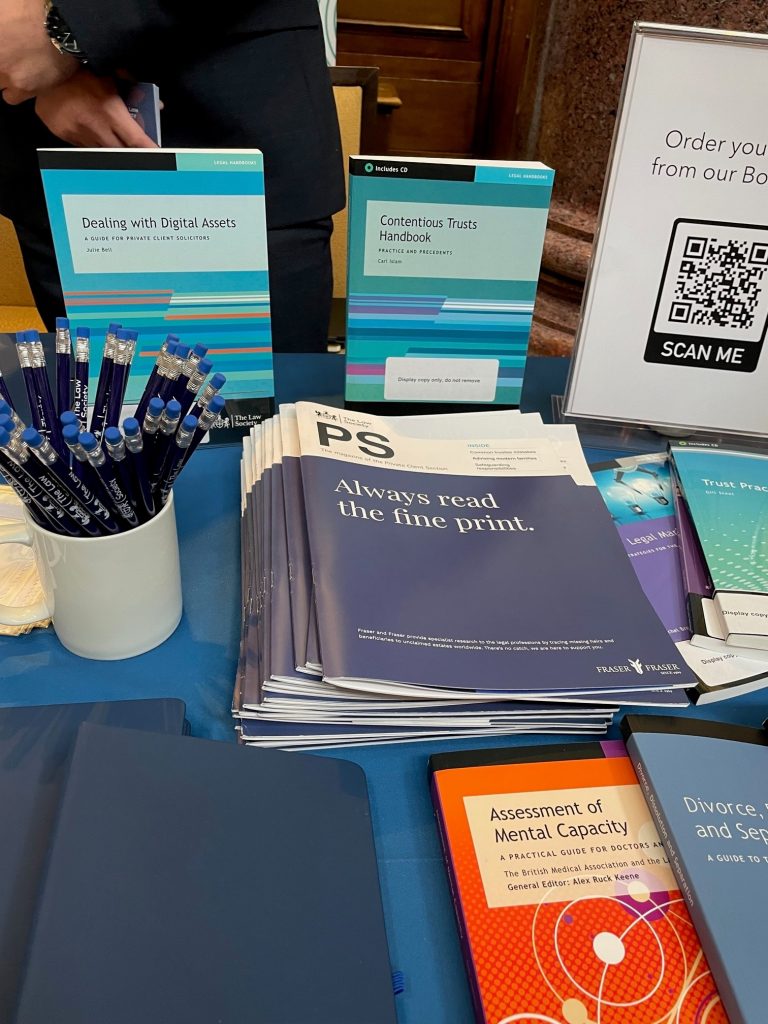

‘My book the “Contentious Trusts Handbook” – Centre stage at the Law Society Private Client Conference 2023’

My book, the ‘Contentious Trusts Handbook’ took centre stage on the marketing stand at the Law Society Private Client Conference 2023 held on 28 June at the Law Society’s historic main office at 113 Chancery Lane, London. This image was forwarded to me by my editor at Law Society Publishing. My next book – which I have already started writing, will be the 2nd edition of the ‘Contentious Probate Handbook’. I am aiming to complete and submit the final draft to my editor at the Law Society in November 2024. This will contain a comprehensive new chapter about ‘mediating’ and ‘mediation advocacy’ in trust and estate disputes. To download and read my four recent articles about mediating trust and estate disputes, including – ‘Mediating Probate and Trust Disputes – Process Challenges and Tools – Part 2’ published by Oxford University Press in Trusts & Trustees 24.06.2023 [Abstract: https://lnkd.in/eqSkkQhG] and Part 1 (published worldwide in print in the Journal – February 2023); ‘Mediation and Estate/Business Succession Planning’ published in Taxation by Tolley 08.03.2022; and ‘Mediation and the tax-efficient settlement of probate disputes’, published in Taxation by Tolley 01.03.2022, please visit the ’Publications’ page at www.carlislam.co.uk. For book reviews please visit the ‘Contentious Trusts Handbook’ and ‘Contentious Probate Handbook’ pages of my website. Since December 2020, I have been studying part-time for a Diploma in Art Law at the Institute of Art & Law in London (https://ial.uk.com/), and going forward as a practising Barrister, CMC Registered Mediator, and author, I am developing a niche research and writing interest in ‘Art Business Contracts’, see the ‘Mediation of Art Disputes’ page at www.carlislam.co.uk. The provisional title of my three Diploma essays, which have to be written in addition to the ten compulsory course modules which students have to undertake are:

– ‘Deaccessioning Art and Cultural Heritage – The Legal and Ethical Framework.’

– ‘Mediating Cultural Property Disputes.’

– ‘Art Business Contracts.’

Working drafts are available to view on the ‘Mediation of Art Disputes’ page at www.carlislam.co.uk.

‘Infrastructure project and business opportunities in MENA if there is a convergence of interests’

On 16 May 2023 I put the following question to Professor Anoush Ehteshami (Professor of International Relations in the School of Government and International Affairs, Durham University), following a talk he gave to the Centre for Geopolitics at Cambridge University about ‘The Geopolitics of China’s Belt & Road Initiative and Western Focus’ – Q. ‘Is the potential for “convergence” in MENA a geopolitical “pivot” upon which war can be avoided in the South China seas?’ To hear the full answer Professor Ehteshami gave click on the following link and then fast forward to the Q&A at 58:02 to 1.11 using the progress bar underneath the video or on your smart TV search You Tube for ‘Anoush Ehteshami’ + ‘China’s Belt & Road’:

https://lnkd.in/eeEnAbHc

In his answer Professor Ehteshami connects:

(i) The conclusion of the UN that a better world requires the building of infrastructure.

(ii) The UN’s estimated cost of building this infrastructure of anywhere between $15-30 Trillion.

(iii) Who is going to pay for it?

(iv) The opportunity that exists for a dialogue about connectivity.

The business opportunites that exist for multinational companies in MENA are huge, provided ‘convergence’ can take place – see the ‘Geopolitical Mediation’ page at www.diplomaticlawguide.com. He describes Iran as the last ‘El Dorado.’ So, if your company is not switched on to the opportunities he describes, I would urge you to listen to his answer to my question. There appears to be an opportunity for business to shape the future of MENA by initiating and leading a mediated dialogue between stakeholders in the region. See also my previous post – ‘The Idea of Geopolitical Mediation’, and the ‘Geopolitical Mediation’ and ‘Negotiating Political Order’ pages at www.diplomaticlawguide.com.